gift in kind donation

Complete the online vehicle donation form or call 833-SHC-KIDS 833-742-5437 seven days a week. A donor can deduct an in-kind donation as a charitable contribution.

Essentials Of In Kind Donations Instructor Name Course Date Ppt Download

By donating toward shipping expenses your donation allows Rise Against Hunger to stretch our.

. By law non-profit organizations cannot provide a donor with the dollar value of an In-kind gift. If you have questions then. Learn more about the program.

They can include donations of land buildings marketable securities equipment furniture vehicles promotional items and raffle. In order to do this the donor must receive a written acknowledgement from the nonprofit to substantiate the. Physical or tangible gifts such as computers furniture office equipment software and clothes.

Some examples of in. You can ask for general in-kind gifts on your donation website broadcast on social media or in an appeal to your supporters. In-kind donations for nonprofits can be made by individuals corporations and businesses.

Not only are the written acknowledgment requirements complex especially for non-cash donations but noncompliance can be costly generally 10 per contribution. Your donation will help support the cost of sending life changing aid to our beneficiaries. Gift-in-kind donations are then placed in the hands of those in need.

The process is easy and your gift may qualify as a tax. For corporate gifts youll probably need to send an. Such valuations when applicable relative to fair market value of In-Kind gifts need to be.

Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits. After a Gift In Kind non-cash donation is made each campus department is responsible for issuing a donor acknowledgment letter to all donors and keeping a copy on file. Tax-deductible donations are typically gifts contributed to organizations that in the US the IRS recognizes as exempt organizations These contributions can take a variety.

An in-kind gift is recorded in the books and records at fair market value as contribution revenue and also as an asset or expenses in the period received. In-kind donations take on diverse forms. Thanks for your help and for taking this burden off of our families shoulders as they strive toward healing and freedom.

In-kind donations are non-cash gifts made to nonprofit organizations. For a printable wish list click the links below. The entire process of donation pick-up and distribution is covered by procedures that ensure the security of all.

During the years ended June 30 2021 and 2020 285000 and 294000 respectively were sold within the Organizations thrift store with the balance of 59000 and. Gifts in-kind are donations of property other than cash. While determining the fair value of cash.

A donation is a gift for charity humanitarian aid or to benefit a causeA donation may take various forms including money alms services or goods such as clothing toys food or. Reporting contributions of nonfinancial assets 8 months ago 10 min read SECTION EXCLUSIVE Resource download available Since the standards for recognizing.

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Letter Templates Templates

Free In Kind Personal Property Donation Receipt Template Pdf Word Eforms

Tax Benefits Of Stock Donation In Kind Financial Pipeline

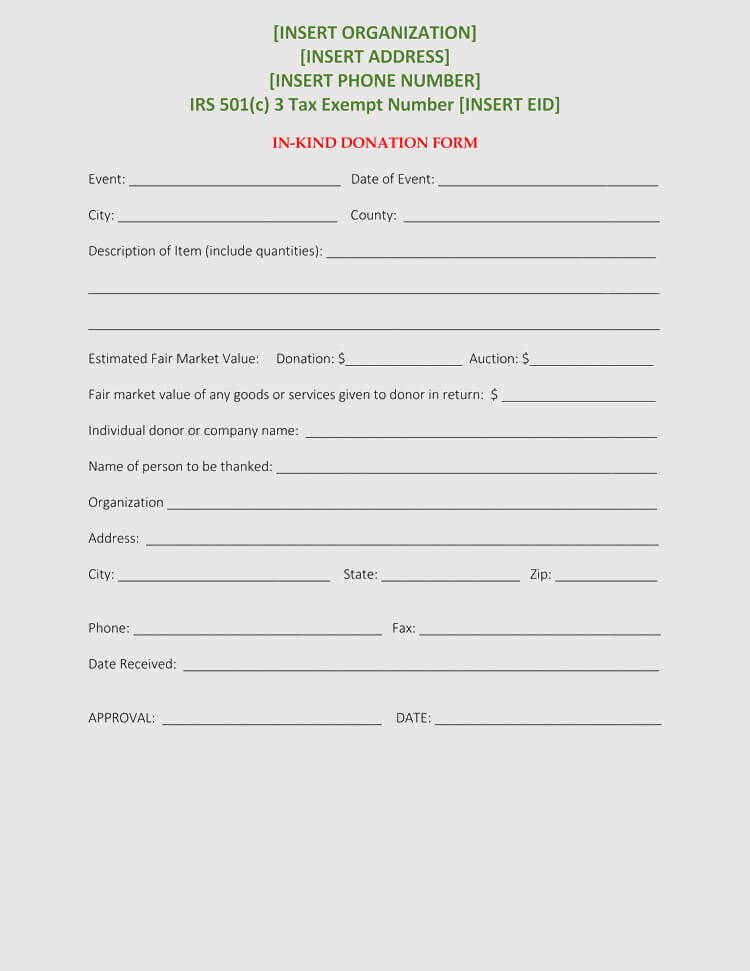

Fillable Online Rlc Gift In Kind Donation Form Rlcedu Fax Email Print Pdffiller

Secured Gifts In Kind Auction Donation Form Pto Today

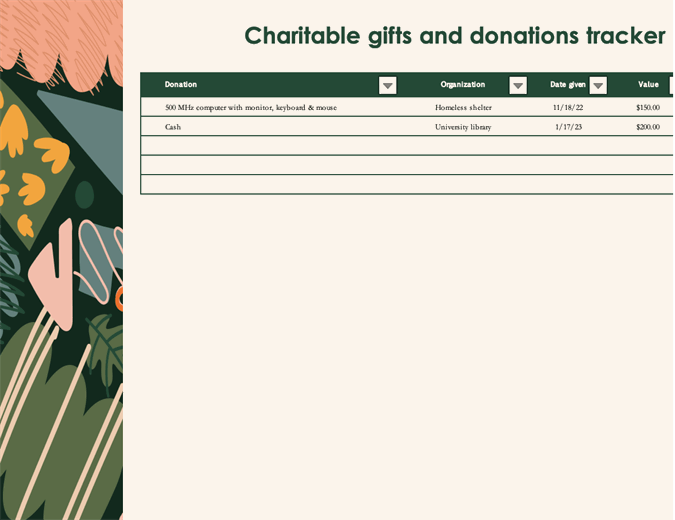

Charitable Gifts And Donations Tracker

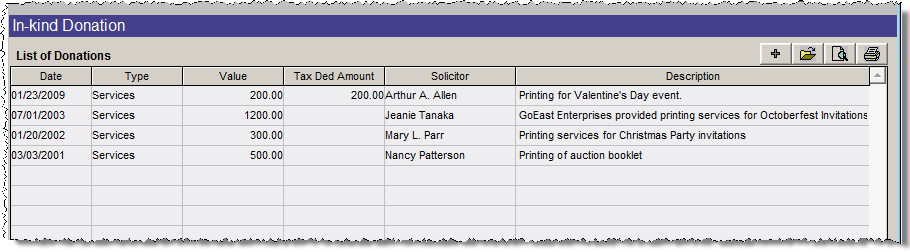

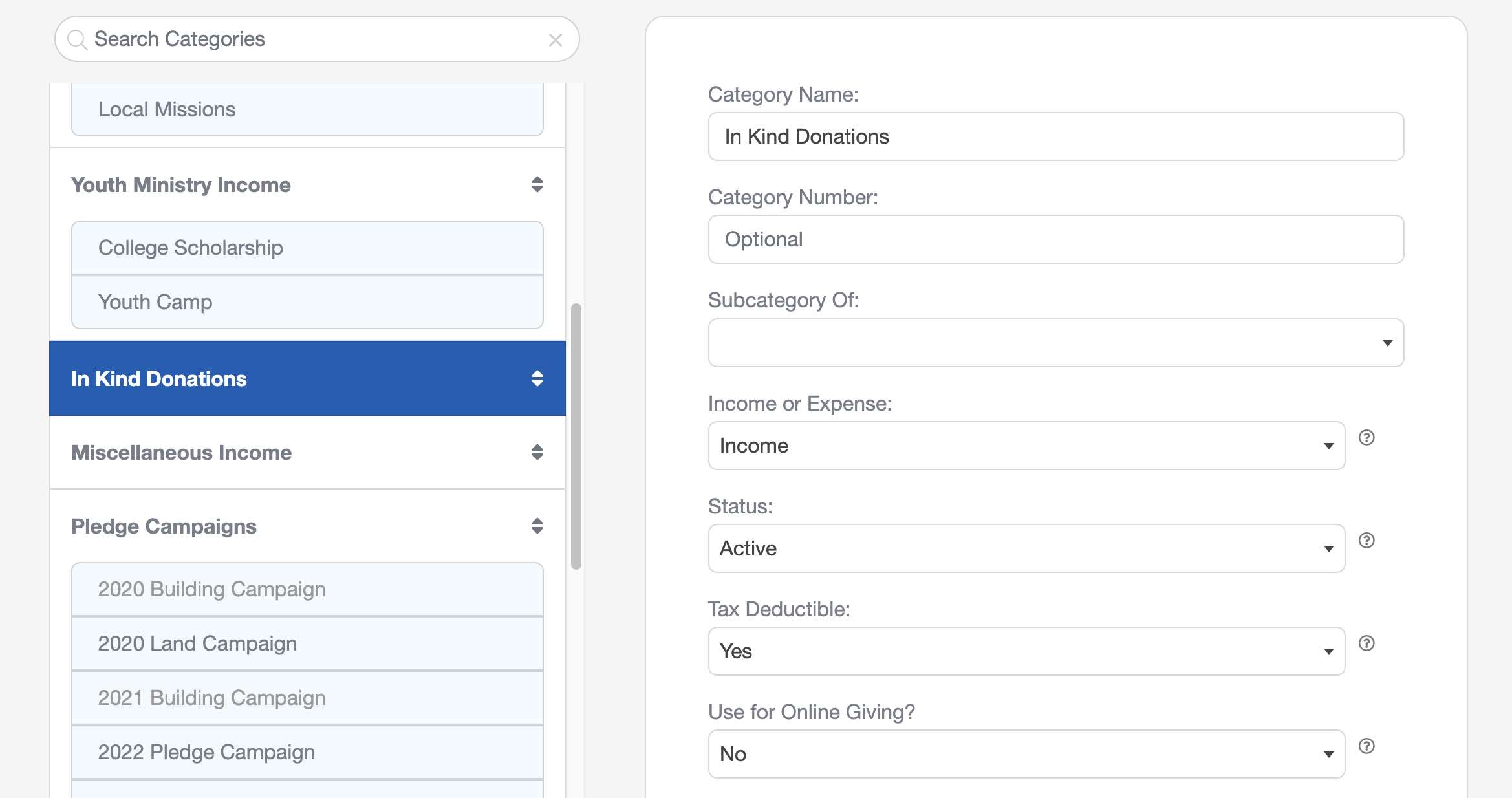

Handling In Kind Donations Churchtrac Support

In Kind Donations Lake Travis Cleanup

In Kind Gift Form Attachment Providing Help Creating Hope

Gifts In Kind Donations Habitat For Humanity

In Kind Donations Everything Your Nonprofit Needs To Know

Gift In Kind Receiving Humanitarian Software

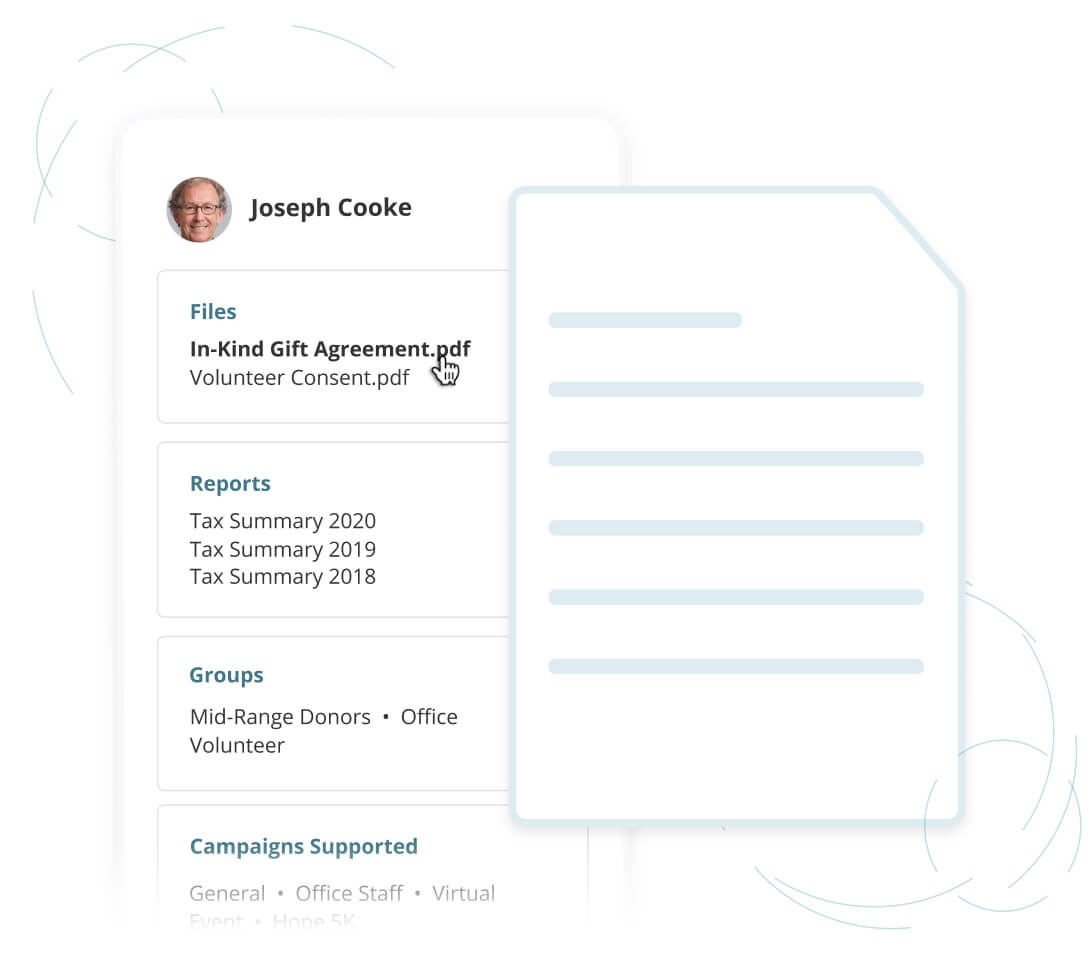

Receiving Recording And Processing Donations Populi Knowledge Base

Thank You Letter To Donors What To Say 20 Samples Examples